There is good news and bad news regarding homeowners insurance coverage for chimney repair. The good news is that harm caused by an abrupt, unplanned event is typically covered.

The bad news is that normal wear and tear-related damage is often never covered. You must comprehend how your insurance policy provides coverage in order to decide if you may make a claim for the damage to your chimney.

Is chimney repair covered by home insurance? The two most frequent scenarios in which chimney repair is covered by homeowners insurance are:

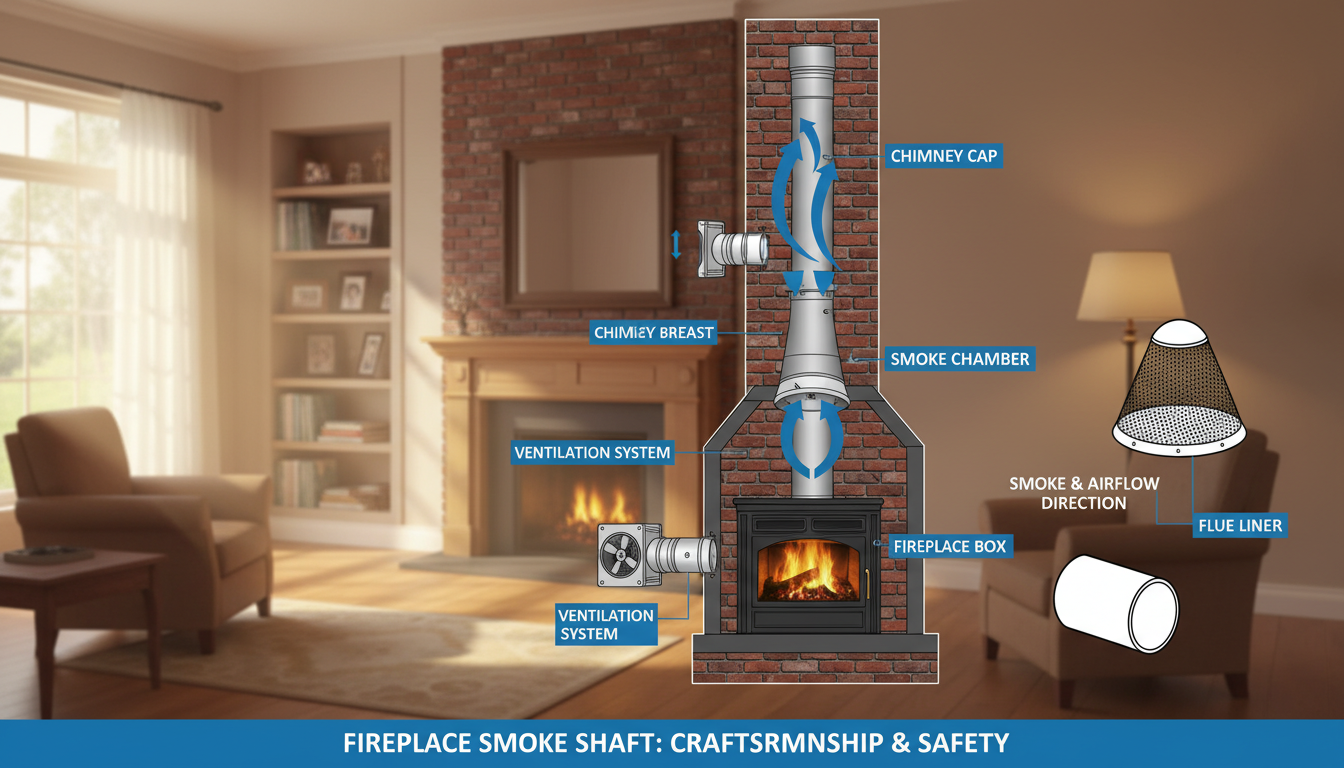

- Chimney struck by lightning: The chimney is frequently the tallest point in a home, and many chimney caps are made of some sort of metal mesh. These might draw lightning, and that might harm the chimney.

- Chimney fire: If a fire escapes the firebox and chars or cracks the interior of the flue, the chimney may also sustain internal damage.

We will assist you by describing some typical claims that are covered, some that are not, and tips to improve your chances of receiving assistance for chimney Repair Covered By Home Insurance.

What Could Be Covered In A Chimney Repair?

Here are a few terms that are covered in a chimney repair.

Fireplace Fires

Contrary to popular assumption, chimney fires are typically classified as abrupt or unexpected events by insurance providers. This indicates that your homeowners’ insurance would likely cover the damage if your fireplace triggered an unforeseen chimney fire. However, your insurer will not pay for the repairs if the fire was caused by carelessness or inadequate maintenance.

Lightning

If a chimney were to fall as a result of a lightning strike, it may also cover the cost of damage and repairs. The only difficult part would be proving that lightning, not a structural issue or instability, was what was causing the main issue.

Leaks

Leaks are another frequent problem that homeowners encounter, and if they are left unattended, they might force you to undertake a major house redesign. A chimney water leak that was caused by an external source, such as a severe storm, may be covered by a homeowner’s insurance policy. However, it is crucial to talk with your insurance provider about your covered losses.

What May Not Be Covered?

Chimney Due For Improvements

A Chimney Repair Covered By Home Insurance policy can assist in covering the cost of repairs if a tree falls on your chimney, causing it to sag and then abruptly collapse. This is so because a covered hazard, like a tree that fell, was the source of all damage. The damage might not be covered, though, if your chimney was already sagging to one side before the tree fell because repairs were overdue for the chimney.

Insufficient Upkeep

Any type of maintenance difficulties is never covered by the homeowner’s insurance coverage. For instance, bad maintenance and negligence-related chimney deterioration over time would not be covered. Should you submit a claim, your insurer will also deny additional problems like broken bricks and other associated repairs.

Will Homeowners Pay For A Chimney’s Repairs After Water Damage?

Most likely not. There are not many water-related situations that do not entail flooding. I assume it would be covered if there was a plumbing issue that in some way impacted your chimney. Rain and snow wreak damage to chimneys, especially during the freezing and thawing of the winter. It’s not an unexpected occurrence, although it does fall within natural wear and use.

The same holds true for cracks in the crown. Damage is not covered unless it is a direct outcome of an occurrence that is covered.

Is Homeowner’s Insurance Going To Cover Hidden Structural Damage?

It varies. If a poorly constructed chimney is the source of the structural damage, chimney repairs to fix those flaws are not covered. On the other hand, if harm (such as a fire) is brought about by the chimney’s shoddy construction, that harm is covered. The insurance adjuster is also a factor.

Claim Tips and Tricks

Even if a homeowners insurance policy is in writing, there is some wiggle area in deciding what is and is not covered, and this includes issues relating to chimneys. Here are some insider recommendations for claims involving chimneys that could perhaps be paid but are more likely to not have been:

- If you have a claim-free experience, have had a long relationship with the insurance provider, and have bundled insurance.

- If a homeowner pushes too hard and becomes unreasonable, they may be denied their claim. This may give the insurance company the impression that it is too much trouble; as a result, they pay.

- if there isn’t strong evidence that a sudden, unexpected occurrence didn’t happen.

People also ask

What would happen if your chimney gave way?

Smoke can pose a carbon monoxide hazard and seep into walls, drapes, furniture, and other porous surfaces if the collapse blocks the chimney top. Avoid attempting an independent damage assessment, especially if it’s windy outside. A person may be hurt or killed by falling masonry.

How can I tell whether my chimney needs to be repointed?

Any discernible indication of mortar deterioration is the clearest indication that your chimney needs to be repointed. This can be challenging to see from the ground, especially on taller structures, but there are additional indications, such as any mortar or, worse, brick fragments, falling from the chimney.

From where do the majority of chimney fires begin?

Most chimney fires begin inside the flue, where there is either a buildup of creosote or some other type of obstruction. A chimney fire begins when creosote or a blockage ignites when heat from the fire reaches these flammable components.

Final Thoughts

Your homeowners’ insurance policy, your insurance company, and the representative you work with on a claim will ultimately determine the scope of your chimney repair work and when you need it repaired. Despite being frequently ignored, chimneys play an important role in a house’s structure. It must be able to safely expel gases from your heating system and fireplace.

related articles

0 Comments